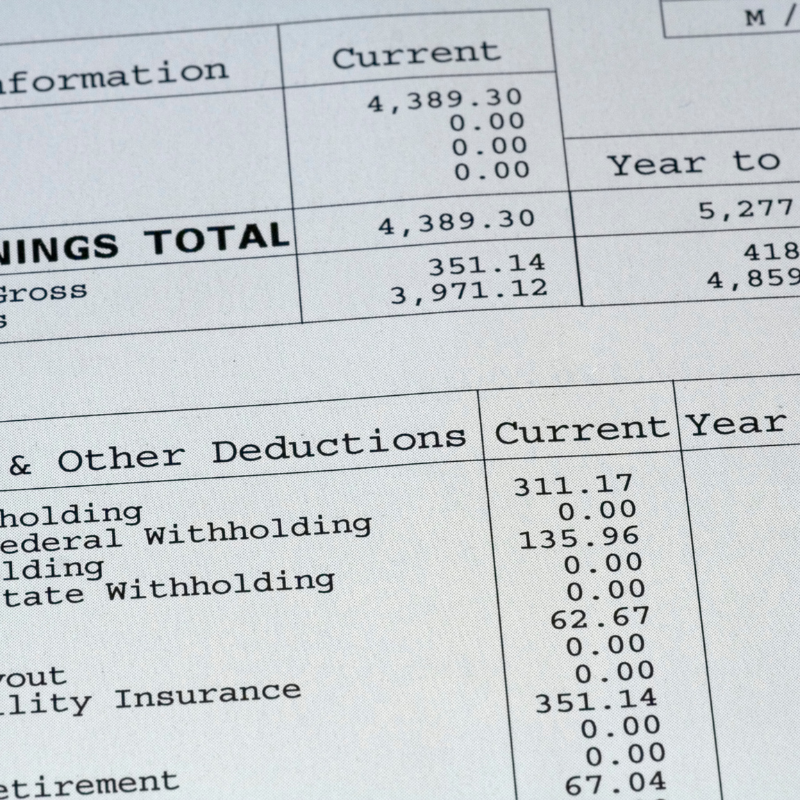

Underwithholding on your paycheck:

- Harrison Greenberg

- Dec 7, 2020

- 1 min read

Updated: Dec 10, 2020

If you are an employee and this applies to you, read on for info on how to avoid an “underpayment” penalty...

To avoid this penalty, this year’s withholding must be the lesser of 100% of last year’s tax liability (110% if your adjusted gross income was at least $150k) or 90% of this year’s.

To do this, contact your HR department and have them increase your withholding on the rest of your paychecks through 12/31.

Reach out to us if you have any questions or need any advice.

Comments